When I started freelance writing a few months ago I had no idea what I was doing. The only thing I had was my laptop and the written word. Eventually I started to get the hang of things like managing my time, how to do research quickly and efficiently, and figuring out which websites actually pay per article and not just ad revenue. Unfortunately what I hadn’t figured out was my finances. I have spent weeks trying to figure out a budget on a constantly fluctuating income only to drive myself absolutely mad with numbers (and as we all know, I DON’T DO NUMBERS).

When I started freelance writing a few months ago I had no idea what I was doing. The only thing I had was my laptop and the written word. Eventually I started to get the hang of things like managing my time, how to do research quickly and efficiently, and figuring out which websites actually pay per article and not just ad revenue. Unfortunately what I hadn’t figured out was my finances. I have spent weeks trying to figure out a budget on a constantly fluctuating income only to drive myself absolutely mad with numbers (and as we all know, I DON’T DO NUMBERS).

The fact of the matter is that trying to plan for things like savings, debt, bills, and moving is a little difficult when you don’t know a) exactly when you are getting paid and b) how much money you will make GUARANTEED each month. And of course I hadn’t even begun to think about Uncle Sam’s share come April 15. Add on top of that a part-time job that also fluctuates depending on teaching gigs and you have got yourself a big numerical mess.

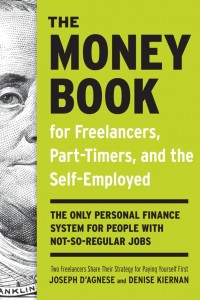

The Money Book for Freelancers, Part-Timers, and the Self-Employed

Cue The Money Book for Freelancers, Part-Timers, and the Self-Employed. Also known as the self-described “only personal finance system for people with not so regular jobs.” For a preview of the book just watch their very witty YouTube video:

(I am happy to say that the book itself is just as witty and entertaining.)

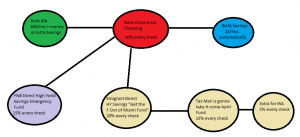

I wish I had found this book back in July when I first started this freelancing self-employment experiment; it definitely would have made my life a lot easier. The system is quite frankly brilliant in it’s simplicity and I can already see my multiple savings accounts growing because of it. It looks a little something like this (click on the thumbnail to view full size):

Believe or not cutting up every check goes a long way when you’ve got your accounts in high interest savings accounts from web only banks. And even the mathematically challenged like myself can figure this out. Of course, I officially don’t have any debt as of a couple of days ago, so the system turned out a little more simple. Considering that Americans collectively owe about $970 billion in credit card debt, I know that is not the case for many people; so if you are considering freelancing for some extra cash or undertaking a self-employed endeavor and have significant debt (school, credit card, mortgage or otherwise) I highly recommend reading The Money Book for Freelancers, Part-Timers, and the Self-Employed. It literally covers every aspect of self-employed finances from taxes and debt to health insurance and retirement.

(By the same token you should probably also read Suze Orman’s The Money Book for the Young, Fabulous, and Broke for effective tips on how to reduce your debt and build your credit.)

And now my public service announcement to freelancers and young adults: GET YOURSELF A HIGH YIELD SAVINGS ACCOUNT PRONTO!!! You really cannot beat the concept of your money making you more money. Below you will find a list of online banks that provide high interest savings accounts. Why internet banks? Because the interest you will make on your money is much higher than it would be at a brick and mortar bank. Note, that if you want to actually use this money you must transfer it back to your checking account which must remain at the regular bank. Some internet banks offer debit cards but that only gives you incentive to waste the money you are saving.

Online Banks that I use:

Emigrant Direct – Both Suze Orman and the Freelancing Money Book mention this one.

FNBO Direct – Mint.com is a big fan of FNBO (and yes, I am well aware of the fact that I am a Mint fan-girl).

Other Online Banks

You can compare and see which one works best for you.

I’m sure that i will come back to your blog. Well written articles !

Thank you for stopping by!!!